Users’ problems we aim to solve:

About The Enhancement:

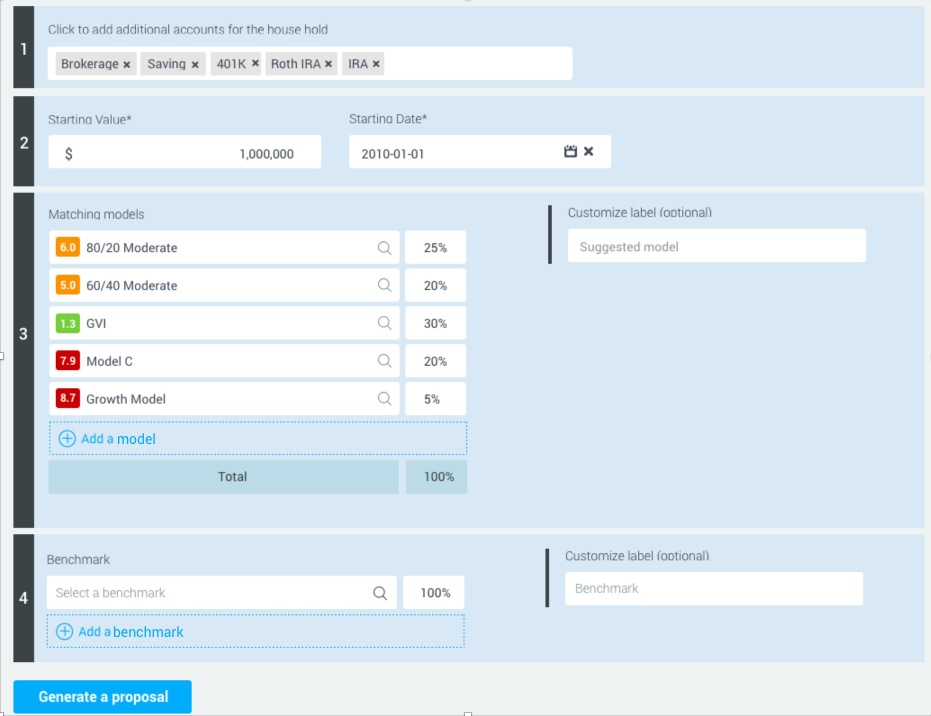

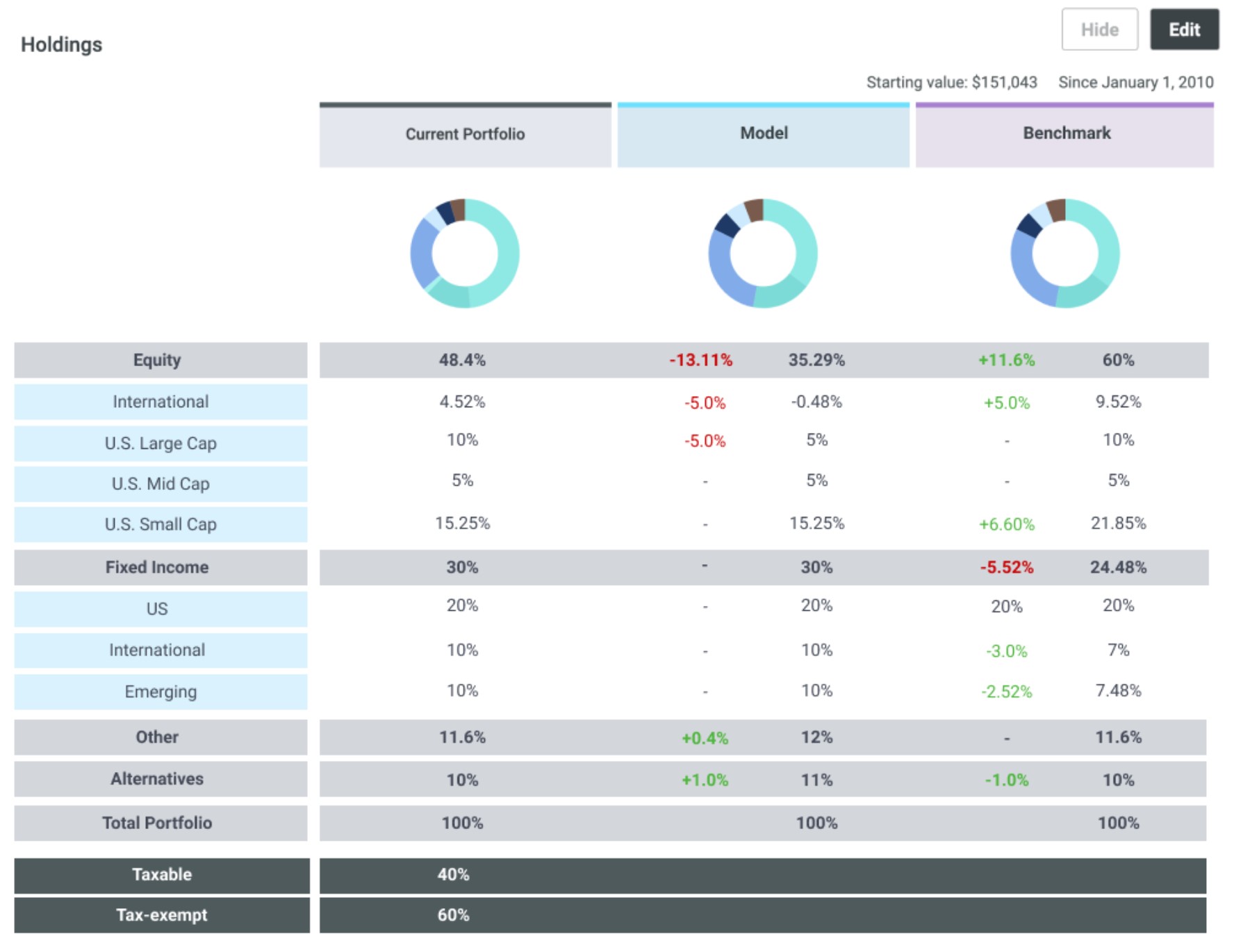

Save tax information and a matching model for each account to generate more tailored proposals. This new feature also allows you to generate proposals with blended models and benchmarks.

Users’ problem we aim to solve:

About The Enhancement:

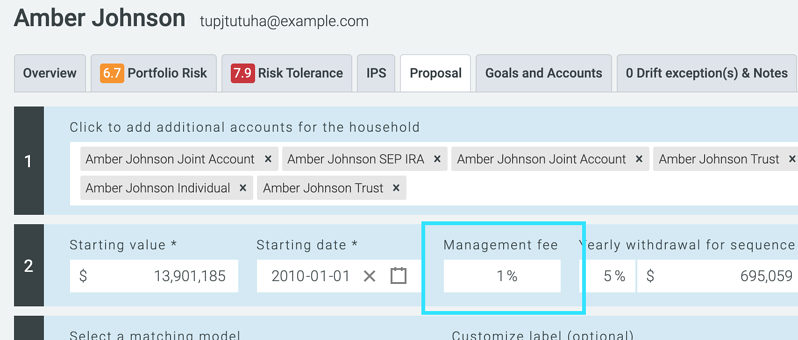

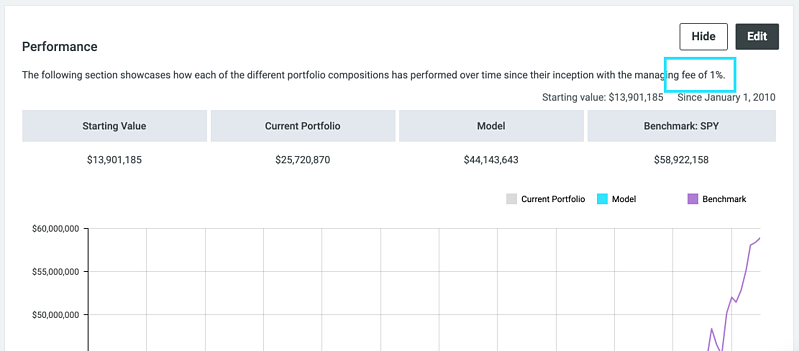

We allow advisors to add management fee to the proposals so that the platform calculates investment performances with the fee deducted.

Users’ problem we aim to solve:

About The Enhancement:

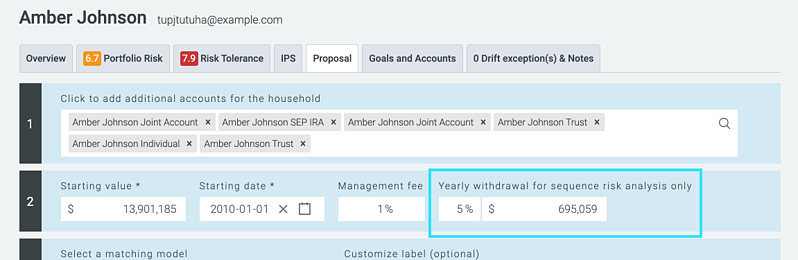

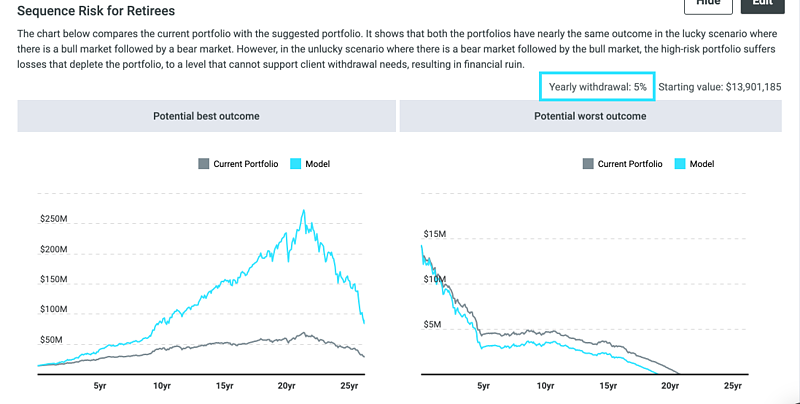

“Sequence risk for retirees” in the proposal already visualized the best and worst-case retirement scenarios. We added a “withdrawal rate” to the proposal so advisors can generate personalized and realistic retirement scenarios for each client.