Table Of Contents

Advisor Perspectives welcomes guest contributions. The views presented here do not necessarily represent those of Advisor Perspectives.

Volatility is not the same thing as risk, and investors who think it is will cost themselves money – Warren Buffett

Low volatility does not mean low risk when it comes to ETFs. By selecting products that minimize losses rather than volatility, advisors can achieve better outcomes for clients.

In recent years, a new type of exchange-traded fund has become popular with investors who are looking to participate in the market while minimizing the effects of price swings. These funds, known as low-volatility ETFs, are designed to track indexes that have been constructed using risk measures such as standard deviation and beta.

Over the past decade, several new low-volatility funds have attracted hundreds of billions of dollars from investors and advisors who may not realize that volatility is not the same as investment risk – as explained in this article. Here, we will analyze the performance of several popular low-volatility ETFs to see how well they have fulfilled their objective to reduce investor risk.

10 Low-Volatility ETFs for a Roller-Coaster Market

A recent article in Kiplinger listed 10 low-volatility ETFs that are intended to give investors more peace of mind in the long run. The article provided a good overview of low-volatility ETFs and their benefits, but it failed to mention that low-volatility ETFs did not fare well during the market selloffs related to the global financial crisis (GFC) in 2008 and the COVID-19 pandemic in 2020.

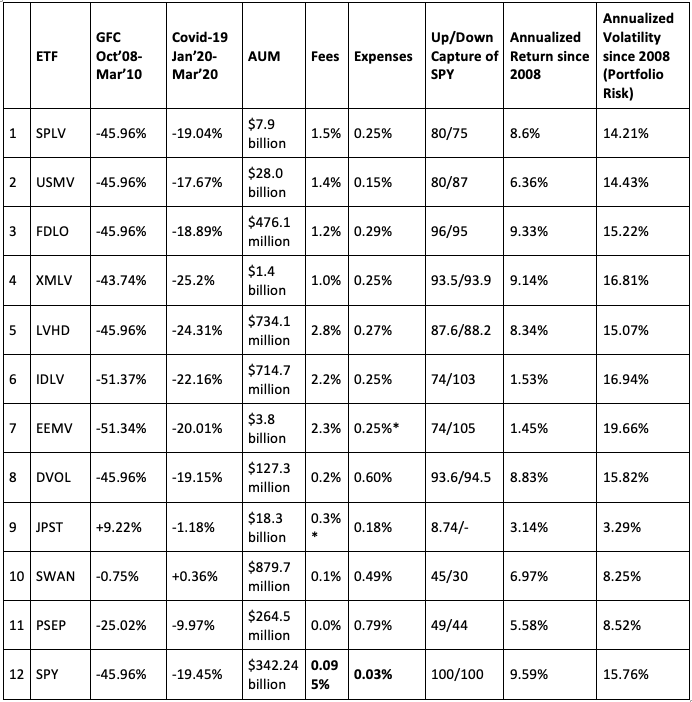

The following table shows the performance of several low-volatility ETFs. These funds did not provide the downside protection that investors expected.

The table above shows the performance during the global financial crisis (GFC), COVID-19 pandemic, the fees and expenses, up/down capture ratios, return, and standard deviation of low-volatility ETFs.

Those funds are supposed to reduce risk in different ways, employing various strategies such as low-vol, min-vol, and “buffering.” Let’s take a closer look at low-volatility ETFs by evaluating their performance by assets, fees, and a hidden risk factor that could help investors make better investment decisions to avoid costly mistakes.

Equally weighted portfolio of five ETFs by highest AUM

When looking at a list of low-volatility ETFs, one of the first things an advisor will likely consider is the assets under management (AUM) of the fund. Let’s look at an equally weighted portfolio of five low-volatility ETFs by highest AUM.

The funds with the most assets should have the best performance, but this is not always the case. Just because a fund has a high AUM does not mean that it will perform well during periods of market stress.

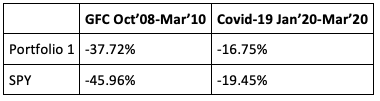

The following table shows the performance of this portfolio during different time periods:

Portfolio 1: Equally weighted USMV, JPST, SPLV, EEMV, XMLV

Investors investing in low-volatility funds expect to capture a significantly lower level of risk than the market. However, despite outperforming the SPY in both periods, this portfolio captured 85% of the downside of the market during periods of stress. This may be much higher than the risk tolerance of investors who are picking low-volatility investments to reduce risk and losses.

Equally weighted portfolio of five ETFs by highest fees versus SPY

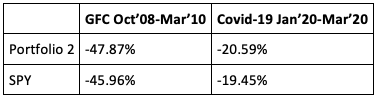

Another consideration when investing in any fund is its fees, and it’s important to make sure you are getting the most value for your money. Funds charge higher fees because they claim to provide a higher quality product. In the case of low-volatility ETFs, this means that investors are paying for a fund that will deliver lower risk and higher returns. Let’s look at an equally weighted portfolio of five highest-fee low-volatility ETFs. The following table shows the performance of this portfolio during different time periods:

Portfolio 2: Equally weighted USMV, IDLV, SPLV, EEMV, LVHD

As we can see, this portfolio underperformed the SPY and captured more than 100% of the downside during periods of stress. The fees did not justify the lack of outperformance during these periods.

What can investors do to safeguard themselves against the hidden risks in low-volatility portfolios?

Equally weighted portfolio of five ETFs by lowest PRISM rating versus SPY

One way to protect against underperformance is by evaluating the exposure to tail events. Tail events are those that fall outside of the normal distribution of returns. They can happen suddenly and with little warning, and they often have a large impact on portfolios. This table takes return data from the StratiFi risk evaluation software to identify which ETFs were most exposed to tail events. The table below shows the tail-risk exposure for different funds on a 1-10 scale, where 10 indicates the highest tail risk exposure.

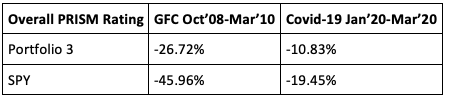

Let’s create an equally weighted portfolio of low-volatility ETFs with the lowest tail risk score. The following table shows the five lowest scoring ETFs:

Portfolio 3: Equally weighted JPST, SWAN, PSEP, EEMV, IDLV

This portfolio captured 50-60% of the market downside during periods of market stress because it had a lower exposure to tail events than the market. This means that it is less likely to experience large losses in the event of a market shock. A portfolio with low exposure to tail events is a good portfolio for investors who want to minimize their drawdowns.

Conclusion

Despite the hype, advisors need to be aware of the risks associated with low-volatility ETFs. While these funds may seem like a “safe” investment, they can be quite risky. Many of these funds charge high fees but do not provide the downside protection that advisors expect.

One of the best ways to protect against large losses is to understand the impact of tail events on the low-volatility ETFs and pick the one(s) with the lowest tail-risk scores. Tools like StratiFi’s PRISM rating can help investors understand the risk factors that these funds are exposed to and make more informed investment decisions.

This will minimize risk and avoid paying high fees for a product that does not provide adequate protection.

Akhil Lodha is the founder and CEO of StratiFi, a fast-growing financial technology company empowering investment advisors with sophisticated risk management technology normally only accessible by the largest institutions. Its online platform monitors risk on over $35 billion in assets and is used by leading RIAs to differentiate themselves, enlighten clients about risk, build proposals high net-worth prospects love, and automate surveillance of accounts to reduce liability.