Table Of Contents

How Tech Benefits Advisors and Clients

The Great Recession of 2008 came as a wake-up call for advisors and investors who doubted the performance-shifting characteristics of risk. The historic crash was neither the first nor the last event that altered the prevailing views of risk during the event’s watershed moment. After 2008, existing platforms to assess risk seemed as helpful as the maps of the world before the Copernican revolution.

The market participants who woke up to this reality now recognize the need for a new generation of cartographers to move risk analysis toward greater reliability. For financial advisors, post-2008 solutions must provide a broader view of the critical dimensions of risk, signal day-to-day communications with clients, comply with regulatory changes, and provide a centralized hub for fintech solutions. Since its inception, StratiFi has been focused on all of these priorities.

Map and Mitigate Risk

StratiFi is designed to map and mitigate complex risk exposures, including downside-focused factors (e.g., Tail Event Risk and Diversification Risk) and upside-focused factors (e.g., Concentrated Stock Risk, Volatility Risk). StratiFi tracks these factors across multiple accounts, providing a numeric PRISM score that measures the gap between a client’s risk tolerance and actual portfolio risk. StratiFi also tracks shifts in correlations and probabilities of various scenarios.

Why Integrate Risk with Reporting?

Modern advisors and their clients can’t afford to treat risk either as an abstract concept (i.e., without measurement or visualization) or as an isolated concept (i.e., without a clear connection to specific steps).

By integrating StratiFi with performance reporting providers, advisors can use risk analytics seamlessly to inform timely client communications, compliance, and other critical practice management functions.

Our recommendations for Performance-Reporting Software, in no particular order, include:

- Addepar

- SS&C Black Diamond

- Orion

- CircleBlack

- Bridge

The Best Performance-Reporting Providers

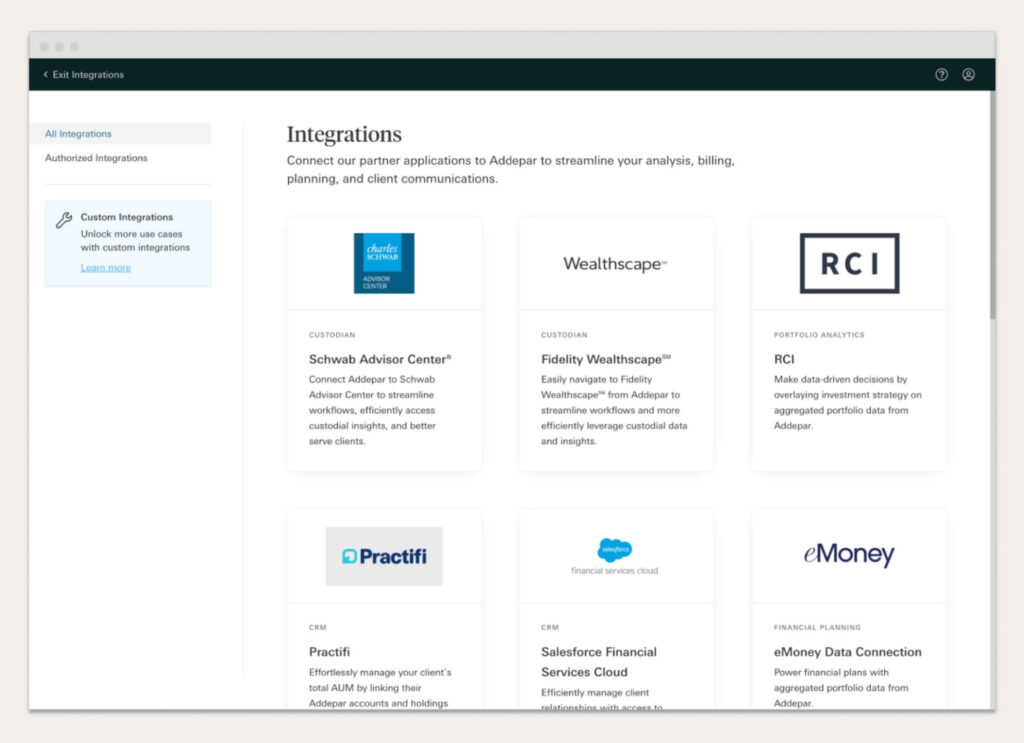

StratiFi integrates with many reporting providers. Learn about several of them below to decide which is best for you:

1. Addepar

Addepar helps more than 700 firms track more than $3.5 trillion in assets, with an average of $15 billion added to the platform every week. Addepar’s industry-leading analytics and performance reporting software allow you to tailor insights and conversations for each client and build long-lasting, trusted relationships. Instantly analyze and visualize portfolio data, communicate relevant insights to your clients on the fly and easily create customized, branded reports in minutes.

Bridge back-office solutions with custom reporting functionality and seamlessly integrate workflows with out-of-the-box integrations. Addepar’s automated data aggregation and verification allows your team to win back hours spent on manual efforts ranging from reporting to compliance.

Why use Addepar?

- Provides a complete view of your client’s wealth

- Custom reporting functionality

- Automated data aggregation and verification

- Client communication

- Multi-currency

- Great for RIAs working in firms

Pricing: Firm-based licenses priced by assets under management (AUM)

2. SS&C Black Diamond

SS&C Black Diamond is a universal wealth management platform that is fanatical about customization, creating bespoke experiences for advisors and in turn, their clients. Transform your business with a comprehensive wealth management platform built for your success today, tomorrow, and beyond. Intuitive dashboards, a cloud-based platform, automated daily data reconciliation, and enhancements every six weeks are part of the solution. Clients have on-demand insight into their complete wealth picture through an immersive portal. The platform is fully customizable, provides compelling visualizations, has secure document storage, and provides advisors and clients anytime, anywhere mobile access.

Why use Black Diamond?

- Intuitive, visual dashboards

- Fully customizable

- Generate and share reports

- Client communication

- Simple drag-and-drop report-building tool

- Run and batch quarterly statements

3. Orion

Orion Advisor Solutions supports more than 2,300 independent advisory firms with $1.9 trillion in assets under administration and $63 billion of wealth management platform assets. Orion Advisor Tech exists to help fiduciary-minded advisors realize their unique vision for success. Our innovative technology includes client experience tools, tax-intelligent rebalancing, efficient billing, integrated planning, and automated compliance monitoring, all aimed at empowering advisors to improve their firm’s productivity, strengthen client relationships, and disrupt traditional ways of thinking.

Why use Orion?

- Branded, customizable reports with various chart and table types

- Client-specific or batch reports

- Client communication (via Client Portal, mail, or email)

4. CircleBlack

CircleBlack combines data integration and aggregation, serving independent and breakaway RIAs, Custodians, Aggregator/TAMPs, and other financial institutions. CircleBlack enables you to quickly see and assess Allocations, Balances, Performance, Exposures, and more, over multiple periods, on all sectors and assets, including held-away accounts. Track portfolio risk and progress towards financial goals with tightly integrated interfaces with the most popular technologies.

Proactive wealth alerts and tasks reduce the time needed to analyze and monitor each client’s account. CircleBlack’s Wealth Alerts and Tasks provide proactive suggestions to determine and communicate the next best step to ensure clients reach their financial goals. CircleBlack’s AI-augmented insights help to drive more meaningful client engagement.

A superior client experience provides transparency and access to portfolio information with CircleBlack’s digital investor portal and investor app. Distribute and receive important documents via a secure document vault, facilitating communication between client and advisor. Engage clients with targeted content and proactive wealth alerts, based on their portfolios. Keep clients up to date on relevant information anytime and anyplace, on any device, to strengthen the client/advisor relationship.

Why use CircleBlack?

- Intuitive investor and advisor experience

- View and analyze multiple accounts

- Multi-custodian integration

- Easy-to-navigate dashboards

- Quick access to client-specific data

- Configurable dashboards

Bridge

Bridge has been on a mission to help advisors break free from legacy providers of financial software. Bridge is built on an open, integration-first portfolio management platform that syncs with all of the best advisor technology solutions on the market. Bridge acts as the portfolio accounting engine and, thus a data source for many advisors by aggregating and reconciling custodial account data each day.

Bridge’s API capabilities open up the opportunity for other technology solutions to leverage Bridge as their centralized data source and provide the advisor with complete, synchronous data across multiple tools without the risk and time associated with manual data entry. APIs provide flexibility when choosing technology solutions and offer the advisors the benefit of using specialized technology solutions.

Why use Bridge?

- Eye-catching, on-demand reports

- Web portal, email, PDF, or printed reports

- Effortless monthly and quarterly reporting

- Customize branding

- Customize report packages, benchmarks, asset classes, and more

For advisors, there’s a better way to work with Atlas. Stop letting legacy tech hold your firm back. Atlas aggregates disparate client data, automates key portfolio management tasks, and delivers proactive insights. Deliver better client outcomes with innovation on your side. Visit www.bridgeft.com to learn more.

Talk To Us

Contact us today to discuss integrating StratiFi’s risk analysis with your performance reporting software!