So far in 2022, we’ve made several exciting updates including support for multiple templates for Proposals & IPS, the option to display securities when listing assets in reports, and more.

About the Enhancement: Allows advisors to select from any number of templates when generating a proposal or an IPS.

Users’ problems this aims to solve:

Why does this help? You will save time by having several templates already stored in the system, being able to select the appropriate one for each circumstance.

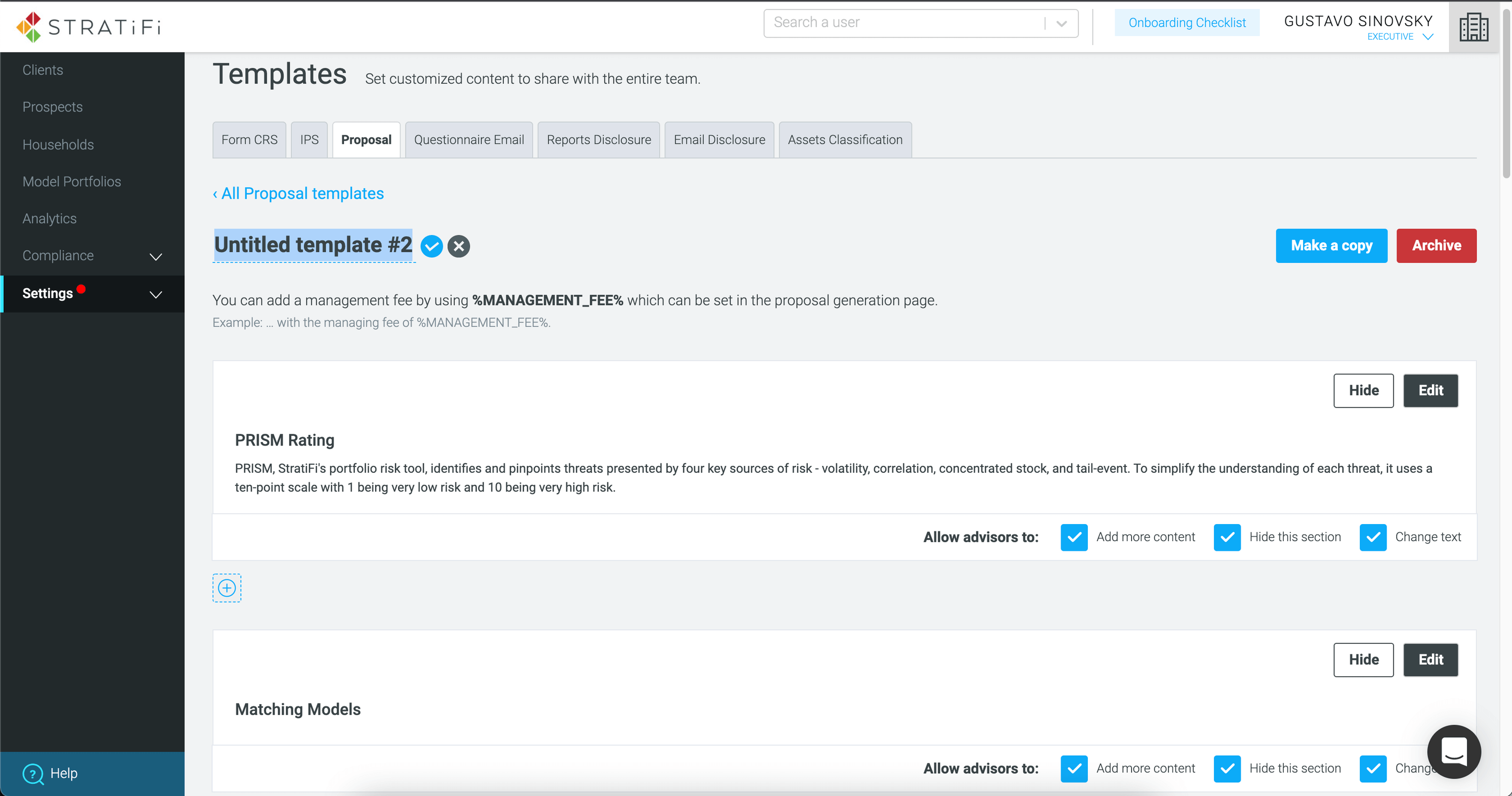

Creating a new template

Creating a new template

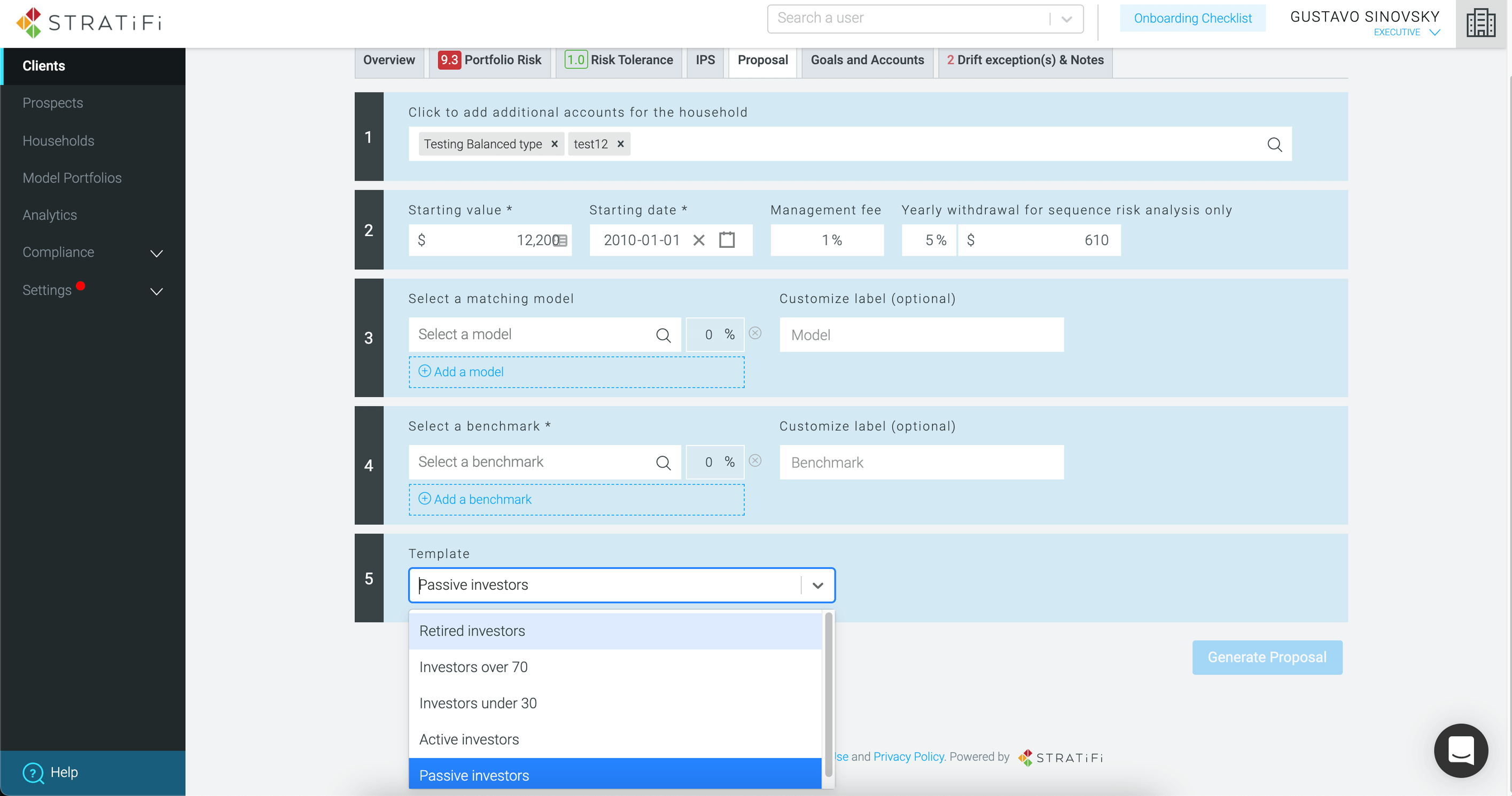

Selecting a template when generating a Proposal

Selecting a template when generating a Proposal

About the Enhancement: Compliance officers/Executives can now enable an option found under Settings → Templates → Asset Classification to display the specific securities when listing assets on proposals and other reports.

Users’ problems this aims to solve:

Why does this help? This offers more control to the advisor on the level of detail displayed on reports.

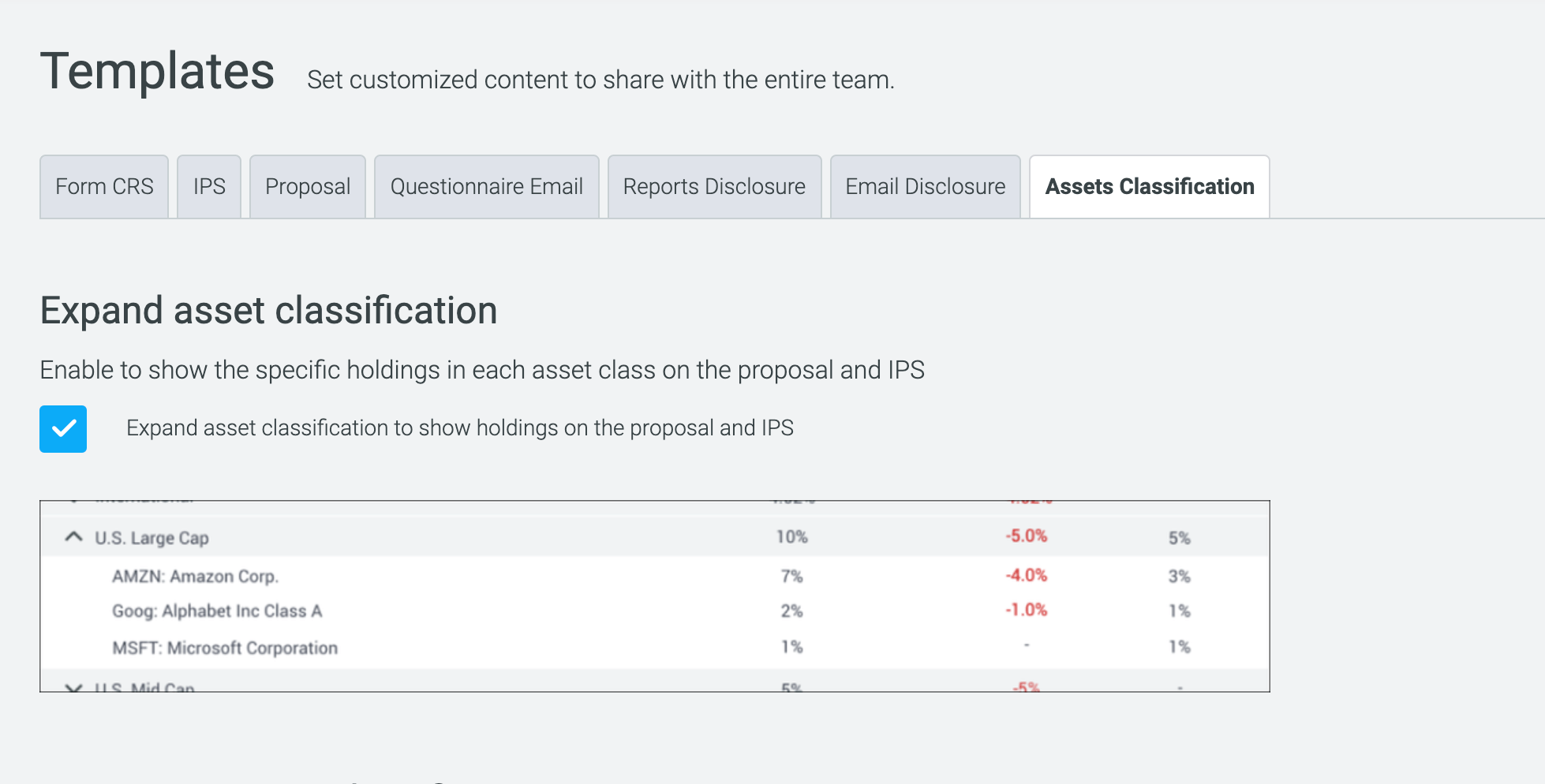

New setting to expand asset classification

New setting to expand asset classification

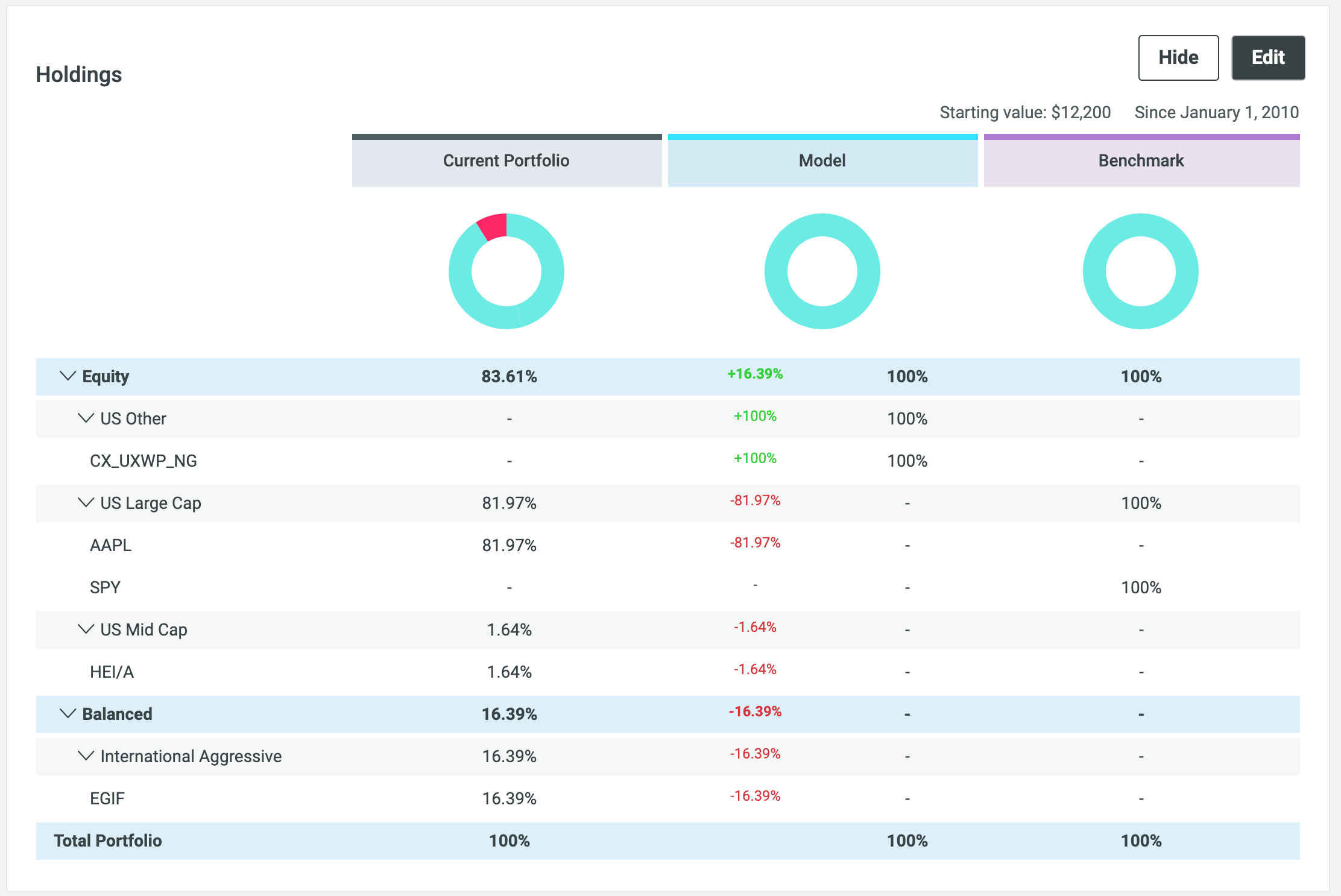

Holdings displaying the specific security

Holdings displaying the specific security

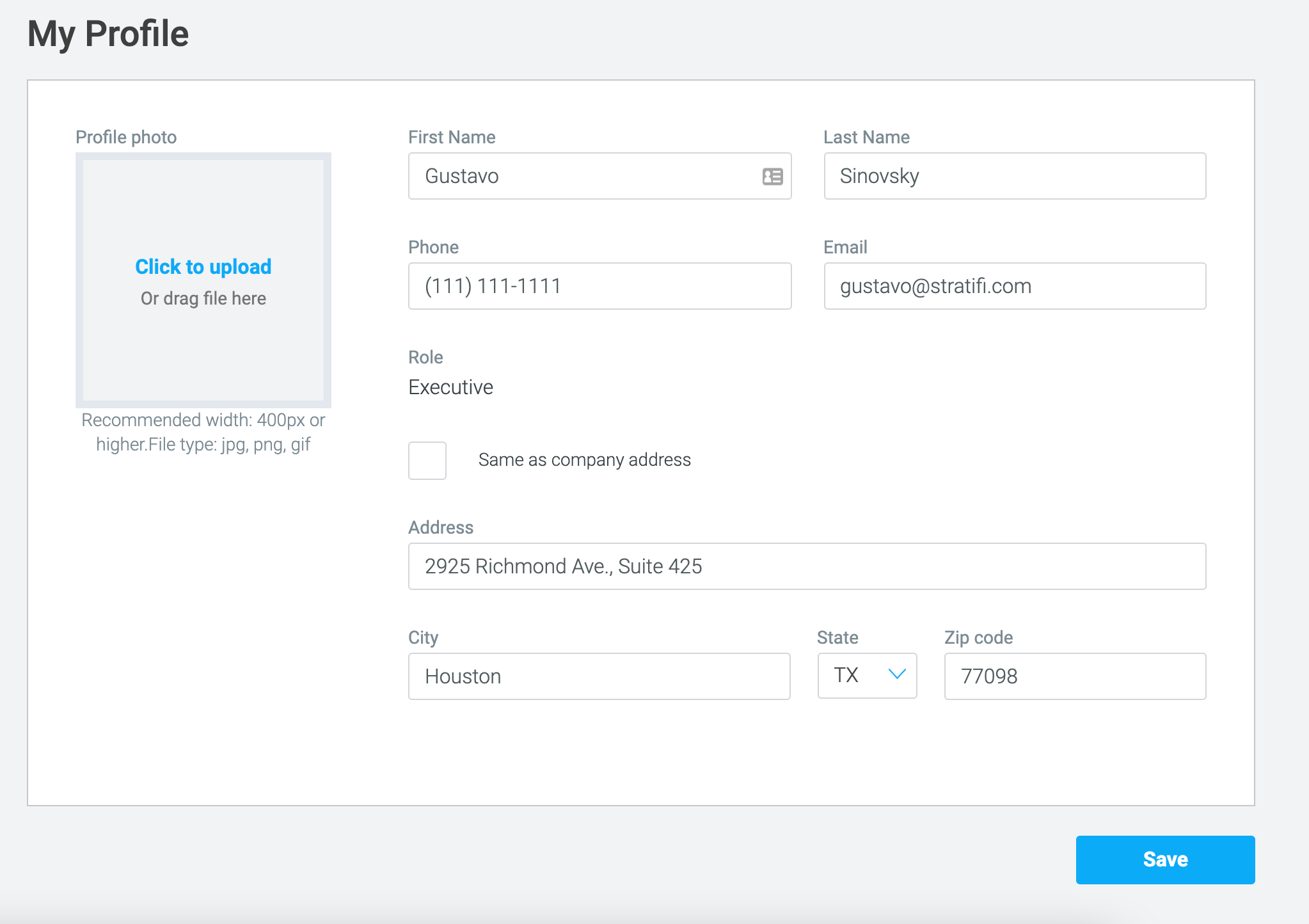

About the Enhancement: Advisors can now set their own address to be used on reports—instead of their company’s.

Users’ problems this aims to solve:

Why does this help? This allows advisors to generate reports with their personal address, instead of their company’s. This allows further clarity and transparency towards the investor.

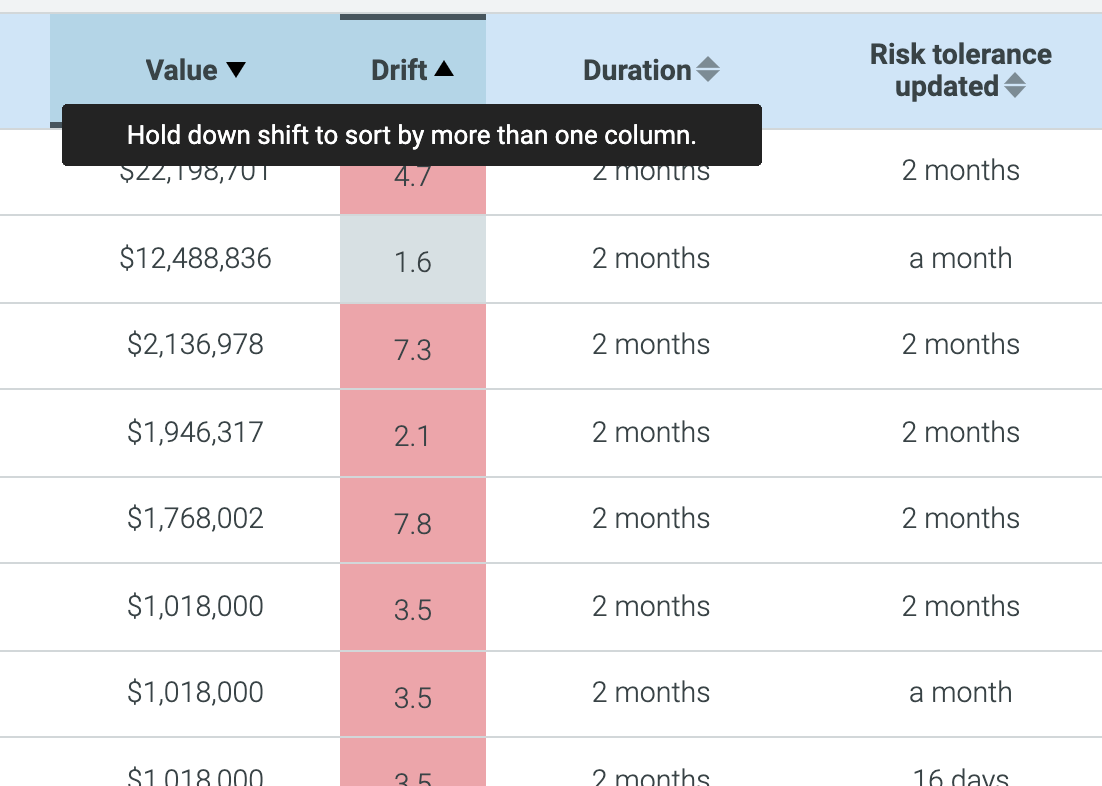

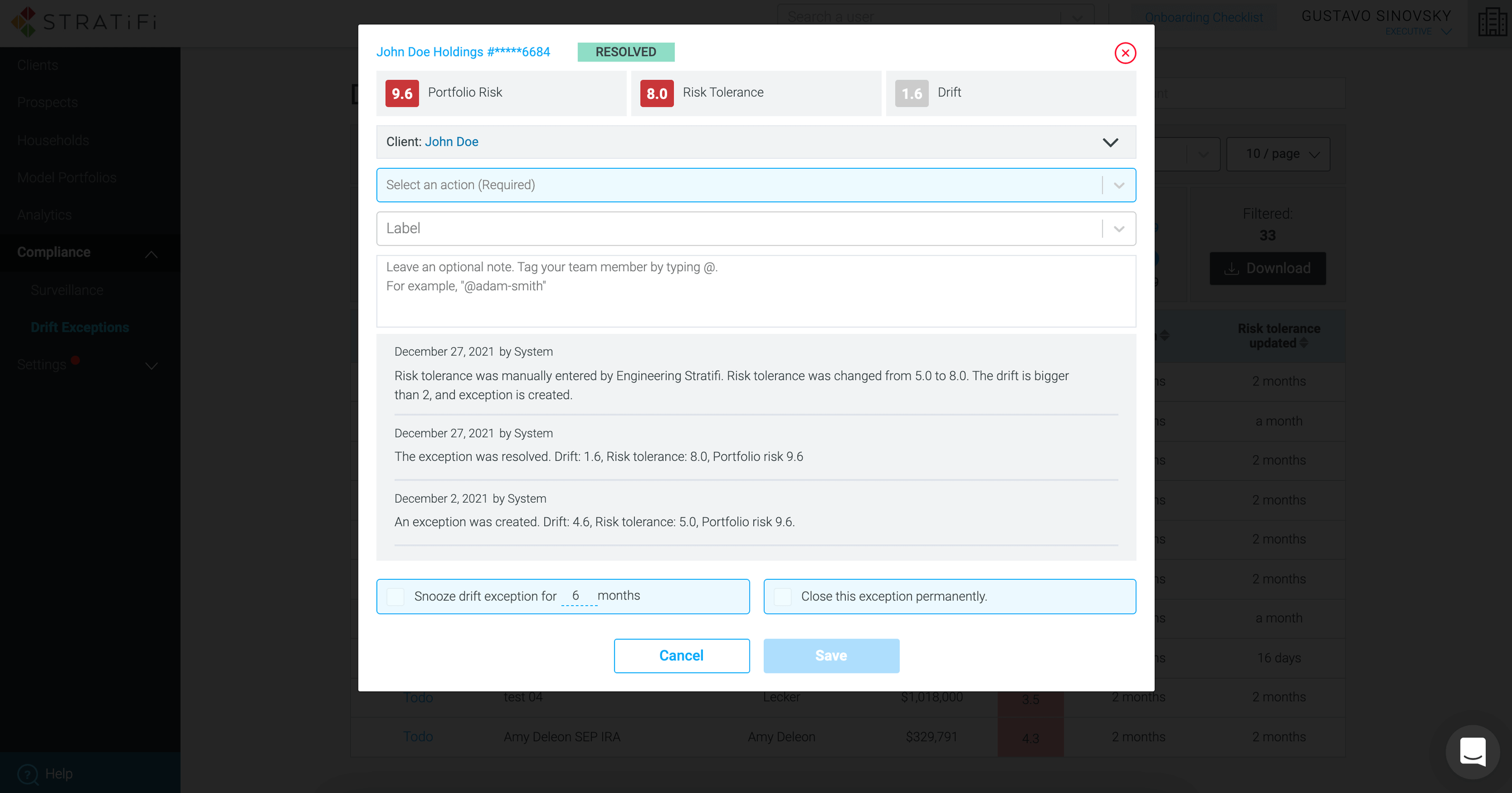

About the Enhancement:

Users’ problems this aims to solve:

Why does this help? The Compliance Officer saves time by getting the most important DEs for their company right at the top, on both the page and the exported CSV.

Please reach out to us at support@stratifi.com with any questions about these updates!

With ♥ from all of us at StratiFi