In December, we’ve made several exciting updates including adding the Portfolio Risk Score section to IPS, improving the custom section’s inline editor, and more. Scroll down for our full list of enhancements this month.

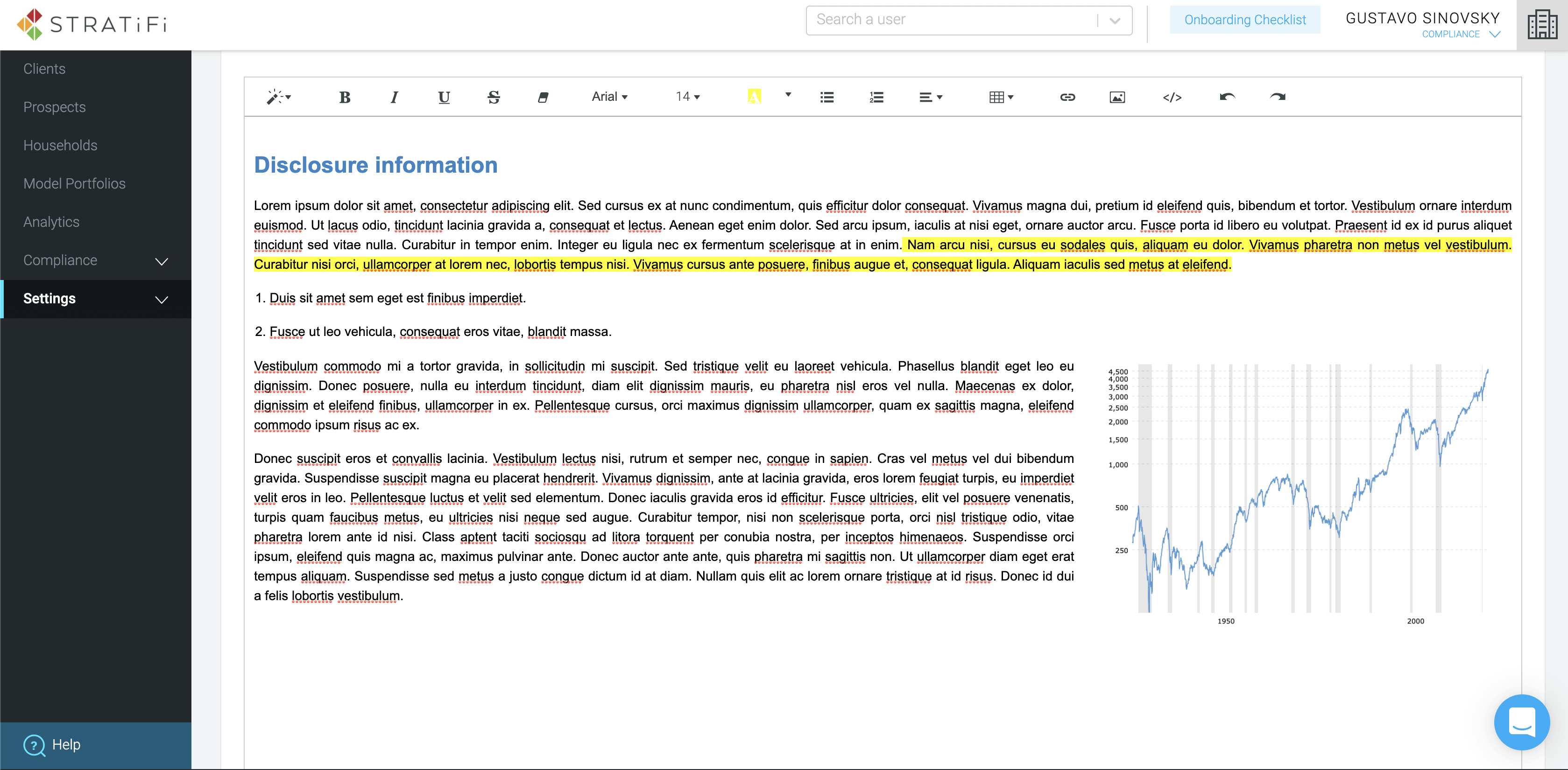

About the Enhancement: Enhances the custom section editor to provide a much more powerful set of tools to adjust styling and formatting.

Users’ problems this aims to solve:

Why does this help? This enhancement empowers the advisor with better customization options and control of the content and look and feel of the reports.

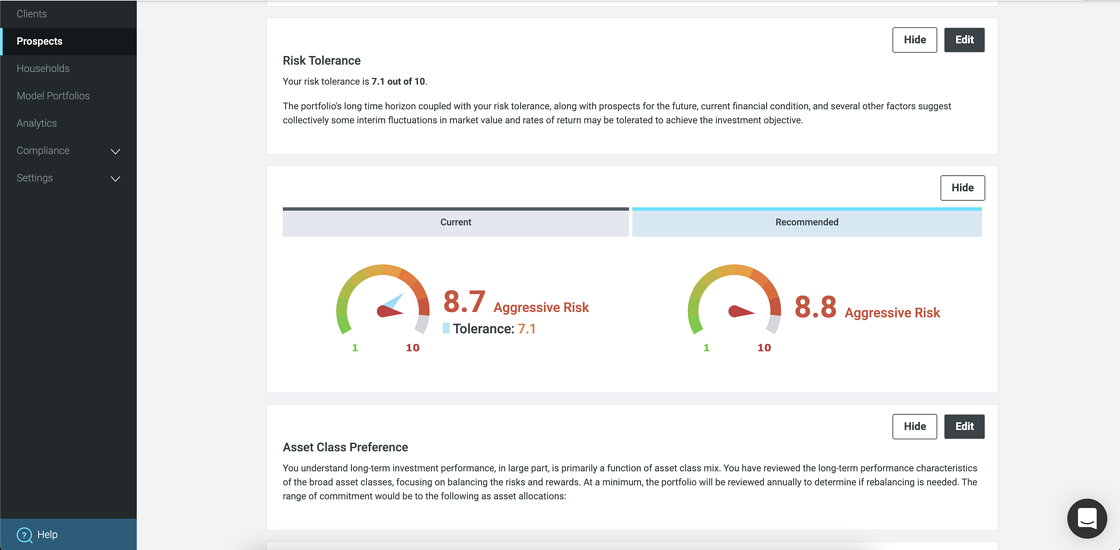

About the Enhancement: A new section is now included on the IPS specifying the client portfolio risk and risk tolerance.

Users’ problems this aims to solve:

Why does this help? This enhancement increases clarity and transparency on the risks associated to the proposed investment strategy associated to the delivered IPS.

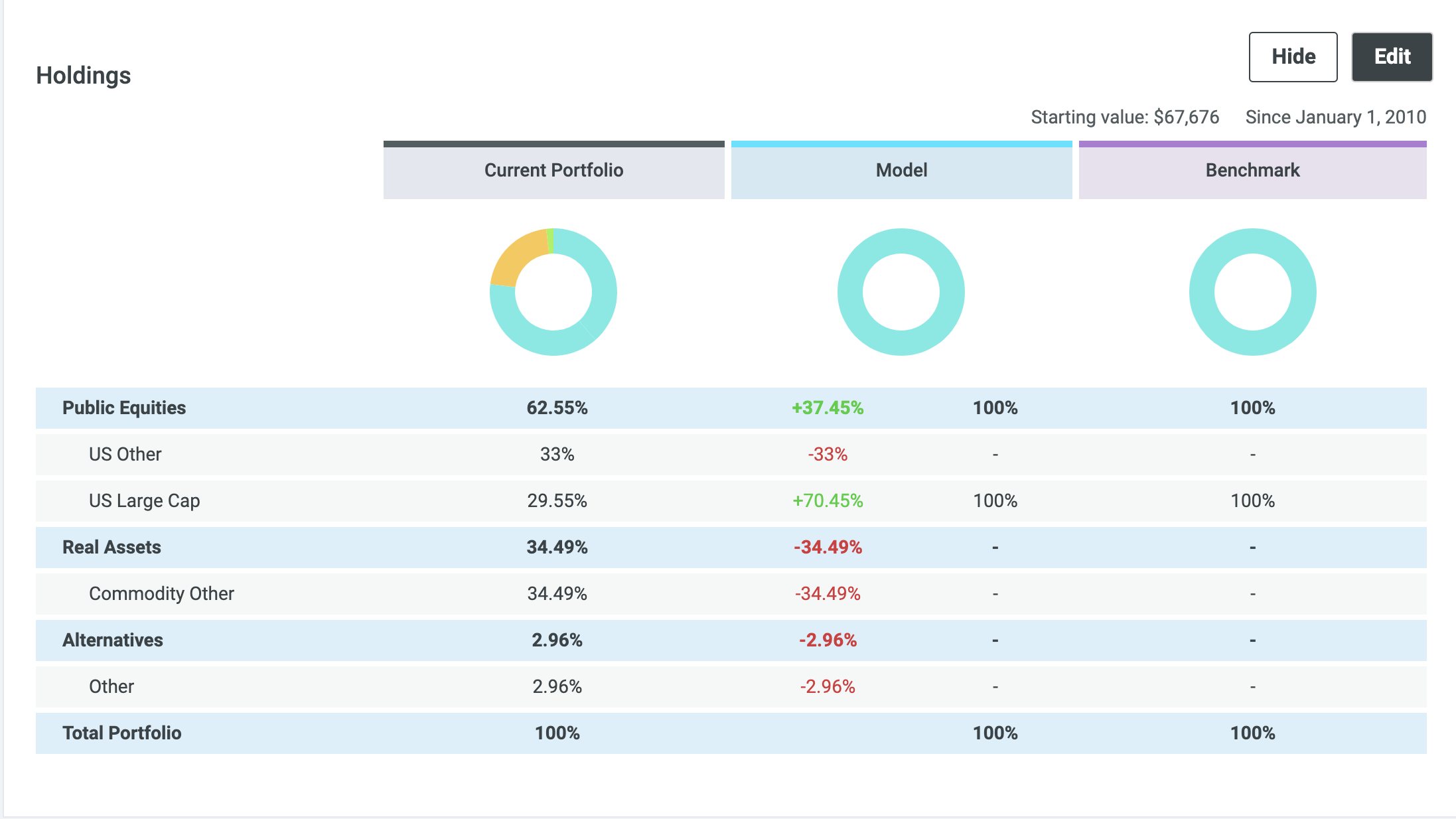

About the Enhancement: Provides control to the advisor on how to list and name the different asset classes and sectors when generating reports. It also improves readability on the asset list. (This enhancement is currently in development.)

Users’ problems this aims to solve:

Why does this help? You will get a greater degree of customization and personalization when it comes to asset listing, making the StratiFi reports more useful and “customer ready.”

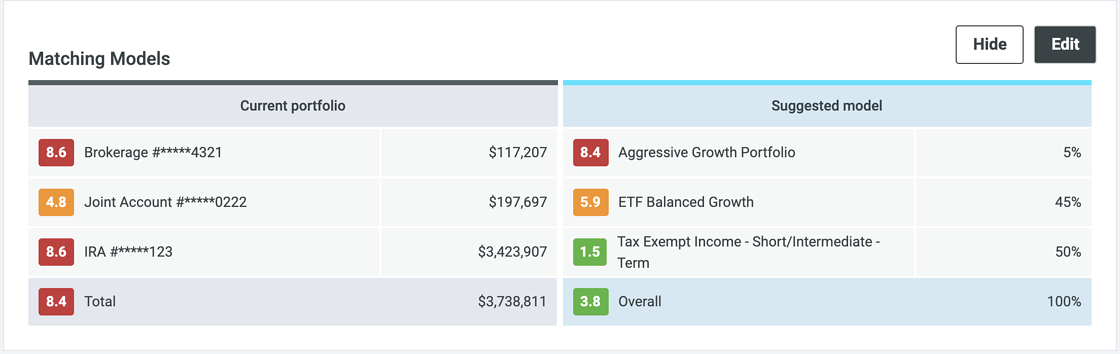

About the Enhancement: A new section is included on all reports displaying the details for the strategy proposed by the advisor to the investor, with names, weights, and risks scores of the associated models. (This enhancement is currently in development)

Users’ problems this aims to solve:

Why does this help? It increases transparency when it comes to inform the potential underlying risks associated to the investment proposal to the investor.

Please reach out to us at support@stratifi.com with any questions about these updates!

With ♥ from all of us at StratiFi