Table Of Contents

Given recent periods of exceptional market volatility and predicted reduced investment returns over the market cycle, institutional and high-net-worth clients, such as mutual funds, hedge funds, endowments, pension funds, and family offices, continue to expect higher standards from their advisors. To satisfy such objectives and create fruitful working connections, it may be essential to have a thorough and well-thought-out investment policy statement.

Let’s dive into this article by first answering some common questions that we receive regarding Investment Policy Statements.

Does an individual investor need an investment policy statement?

An IPS could be much more valuable for a person who invests independently and does not have a professional financial advisor. Self-directed investors usually have an emotional attachment to investments. Therefore it was crucial they established definite guidelines that would guide their money investments.

This document helps investors stay on track and is an important asset. And staying focused on investing can sometimes seem incredibly valuable. Most likely because the research shows how to maintain an investment trajectory.

What is an Investment Policy Statement?

The investment policy statement (IPS) acts as a strategic road map for developing and carrying out an investment plan.

When successfully implemented, the IPS anticipates problems with the governance of the investment strategy, proper asset allocation planning, implementation of an investment management program with internal and/or external managers, monitoring the results, risk management, and appropriate reporting.

The IPS serves as a policy guide that can provide an objective course of action to be followed during times of market disruption when instinctive or emotional responses might otherwise encourage less intelligent choices. The IPS also specifies responsibility for the numerous organizations that might function as investor agents.

What is IPS in wealth management?

In order to meet the needs of high-net-worth individuals, wealth management is an investment advising service that integrates other financial services. Using a consultative method, the adviser learns about the client’s preferences and unique circumstances before creating a customized plan that makes use of a variety of financial products and services.

Such investment preferences, goals, targets, and expectations are laid forth in an investment policy statement. It includes information about the type of investment the client intends to make, the location of the investment, and the amount of the investment.

It gives your financial advisor a clear picture of the client’s objectives so they can make important financial decisions that fit their needs. An investment policy statement essentially serves as a guide for financial advisors, outlining how they should manage the wealth of their affluent clients, develop asset classes, perform asset allocation, and meet clients’ financial goals.

What is IPS risk management?

Investment policy statements limit the possibilities of risks by guiding the investor to adopt strategies that are well-designed and thoroughly assessed. So, instead of going with what seems some kind of lucrative investment, it confines investors to review their investment goals as stated in IPS.

For example, an investor without an Investment Policy Statement may have been easily persuaded to invest their retirement savings in soon-to-be worthless internet stocks during the late 1990s internet bubble.

But an IPS holder would probably be prohibited from putting all of their eggs in that now-empty basket. As a result of the fact that their IPS would have been developed to minimize unneeded risks and keep a diverse portfolio of stocks and bonds. They would have had regulations in their IPS that forbade making concentrated investments.

Here are some of the important elements of risk management that you should include in your investment policy statement (IPS) to enhance your risk tolerance:

Establish performance measurement and reporting accountabilities

The IPS should establish a reliable, objective system for reporting investment results so no investment risks can go unnoticed. For example, it should help define the following areas clearly:

Who will calculate the performance of which investment account?

Who will be the performance analysis reported to?

Which standards are to be followed while calculating the investment performance?

By establishing performance measurements and clear reporting policies, investors can increase accountability which leads to minimized risks.

Establish suitable metrics for assessing and measuring risk

For meaningful comparisons to be made across time, measures that monitor and evaluate the risk profile of investment portfolios must be applied consistently. It is crucial to avoid using different measurements inadvertently to emphasize or hide certain hazards.

However, there is legitimate disagreement regarding the applicability of different metrics, thus it is advised to continue reviewing the metrics that are currently being utilized and those that are accessible.

Define the procedure for bringing portfolios back to the desired allocations

The IPS should include any deviations from targets that are outside of permitted limits (or any other target rebalancing point).

A brief description of the rebalancing mechanism in a separate appendix to the rebalancing policy with references to the risk management process is appropriate in the event that the rebalancing mechanism is integrated with the risk management system.

It should be stated in the IPS if the policy is not to rebalance.

The Importance of an Investment Policy Statement

A well-designed IPS includes instructions for asset allocation targets, including the target allocation for key asset classes (such as equities and bonds) and for sub-asset classes, in addition to defining goals, priorities, risk tolerance, and investment preferences (i.e. global stocks by region). The minimum and maximum deviations that, when surpassed, cause portfolio rebalancing should also be included.

First off, it assists in giving your money a purpose. Knowing why you are investing may make it easier for you to keep to your plan and feel on track. As a result, your investments are in line with when you will need to utilize the money. You can “bucket” your money by having a target asset allocation.

Stocks might be the aggressive bucket to support long-term spending (10+ years), while cash and bonds can be the conservative bucket to support spending in the near future (1 to 10 years).

With short-term expenditure and an overly aggressive target asset allocation, you may be able to see the need to adjust your allocation mix to lower risk in your investment portfolio.

Additionally, it aids in bringing comfort during market crashes. You might feel more at ease sticking with your investment allocation if equities are down in a year but you know you have enough money in the conservative short-term bucket to weather market dips.

The worry of missing out on new investments or a successful asset class may be reduced by deciding on the types of investments you will use, putting down the framework for how you choose investments and monitoring your investments.

Drawbacks of not using an IPS

People who lack policies usually base decisions on daily activities that often lead to the pursuit of short-term performance and may inhibit the achievement of long-term targets. Using a strategy encourages the long-run nature of the investment, especially if there’s an influx of volatility.

But it can be difficult to write an investing policy statement while using a conventional word processor. You have to write each and every clause manually while accessing multiple tools. Not only that, you will have to deal with the following drawbacks as well:

Waste of Time: While drafting IPS manually, you will have to gather information from portfolio managers, individual investors, financial planners, etc. Going back and forth takes extra effort and time horizon which ultimately leads to frustration.

Errors: Since there is human intervention involved, there are high chances of error. Copy/Pasting elements of IPS can be hectic and often irrelevant too. A single mistake in a phrase, sentence, or a missed zero can cost millions to an investment process. As a result, you will be more vulnerable to risks and losses.

Compliance Issues: Adding each and every clause by hand can sometimes also lead to missing opportunity or clause that needs to be addressed. Even though the compliance department is involved, it is possible that conventional communication means can lack in encompassing the full scope of compliance.

Why You Should have IPS

Creating Investment Policy Statements can be a hectic task. As discussed above, gathering information, circling back with the compliance department, and organizing everything in one document require a significant amount of time and effort.

With the help of software, you can eliminate all the possible drawbacks and shortcomings of IPS and can achieve your investment objectives. It helps in saving time as it electronically gathers all the relevant and updated data from different sources. You can send questionnaires and requests for information to different stakeholders of the policy statement to achieve a holistic view.

Instead of editing past statements and leaving out room for errors, you include information that really matters. Easy approvals from compliance departments further ensure that your investment policy statement (IPS) has adequate risk tolerance and cautious future strategies.

Problems Financial Advisors Encounter

Over the past couple of decades, technology has drastically changed the financial sector. Fintech innovations like machine learning and automation make the work of financial specialists for their clients simpler, more effective, and more efficient.

But unfortunately, many financial professionals are reluctant to technology for a variety of reasons, including lack of urgency, the growing generational divide, client training, outdated technology, technical illiteracy, and cybersecurity worries.

Those who have what it takes to adopt a platform for managing investments are unable to find pocket-friendly options that have the required robust features. Although there is software available in the market that has a lot of features, license fees for such software are not easily affordable.

To enhance operations, stay competitive, increase flexibility, reduce expenses, service customers more quickly, keep clients, make better judgments, and build excellent client relationships, financial advisers must utilize new technologies.

At last! Automated Solution to save time and stay compliant

Imagine generating an IPS in under 5 minutes with just a few clicks that compliance approves!

Yes. That is possible with the help of Stratifi. With a help of a simple questionnaire, you can create a Risk Tolerance Score and export Investment Policy Statement based on it within a few minutes. To build a complete multi-page IPS, StratiFi uses client portfolios and a benchmark portfolio. Your complete accounts and risk tolerance are then reviewed. Once reviewed, your risk tolerance score and preferred asset classes get covered in the IPS automatically.

If necessary, it offers a suggested model portfolio, objectives, and goals statement. Finally, the IPS generated also includes information on governance, review, and final signatures. This way your whole IPS is drafted within a few seconds. In the end, the generated report can be customized as per your requirement.

StratiFi helps you create investment policy statement IPS in three simple steps.

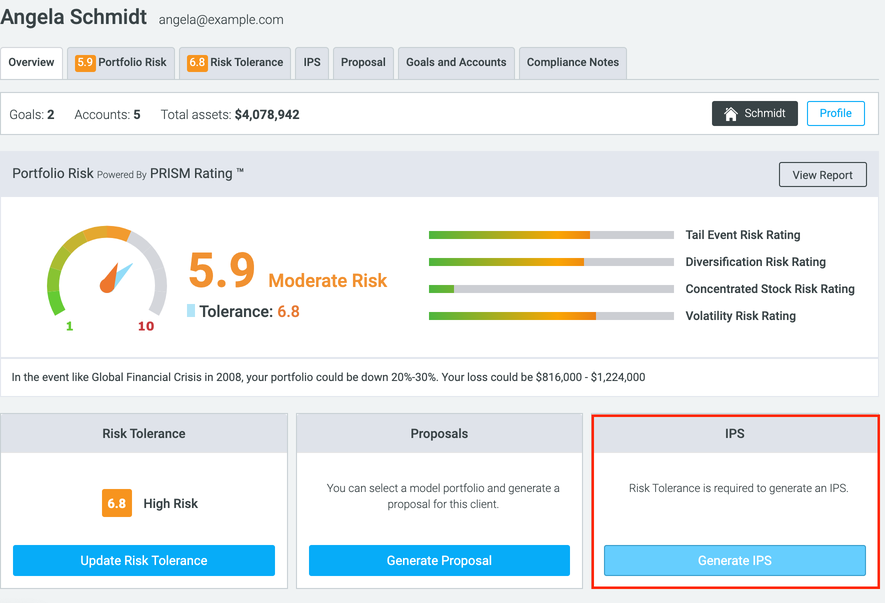

1. From the Client Detail page hit Generate IPS.

Note: The client/account must have a Risk Tolerance score for an IPS to be created. If there is no score, the Generate IPS button will not be enabled. You can hit the Update Risk Tolerance button to send the client a Risk Tolerance questionnaire or to input the score manually if you have an idea of what it is based on investment objectives.

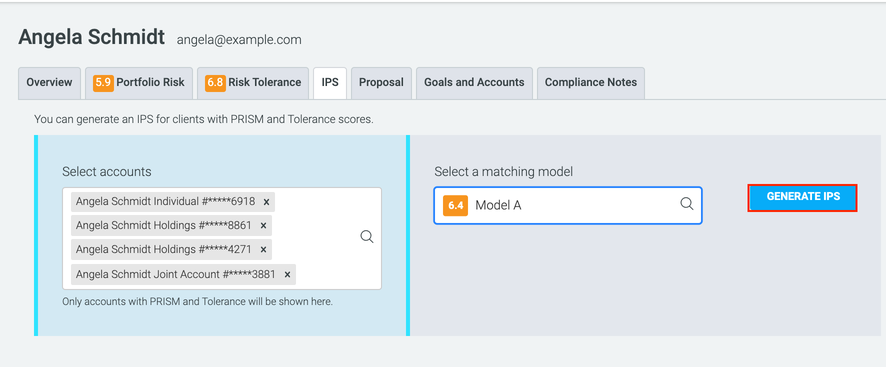

2. Select the accounts and model you want

3. Hit Generate IPS

The Bottom Line

To sum up, it’s crucial for investors to create an investment policy statement if they wish to stay on track to achieve their long-term financial goals. This aids in preserving the portfolio’s alignment with the investing goals within a given time frame. Continuous monitoring makes it easier to rebalance the portfolio according to market circumstances.

Using software to develop investment policy statements can take this time-consuming task out of your hands and can provide you with a roadmap to achieve your or your client’s general investment goals.