Table Of Contents

We live in an era when investors have more information readily available than the world’s most accomplished investors ever imagined just 50, or even 100 years ago. Still, many people complain that it is hard to find useful information in a 24/7 new cycle.

We live in an era when investors have more information readily available than the world’s most accomplished investors ever imagined just 50, or even 100 years ago. Still, many people complain that it is hard to find useful information in a 24/7 new cycle.

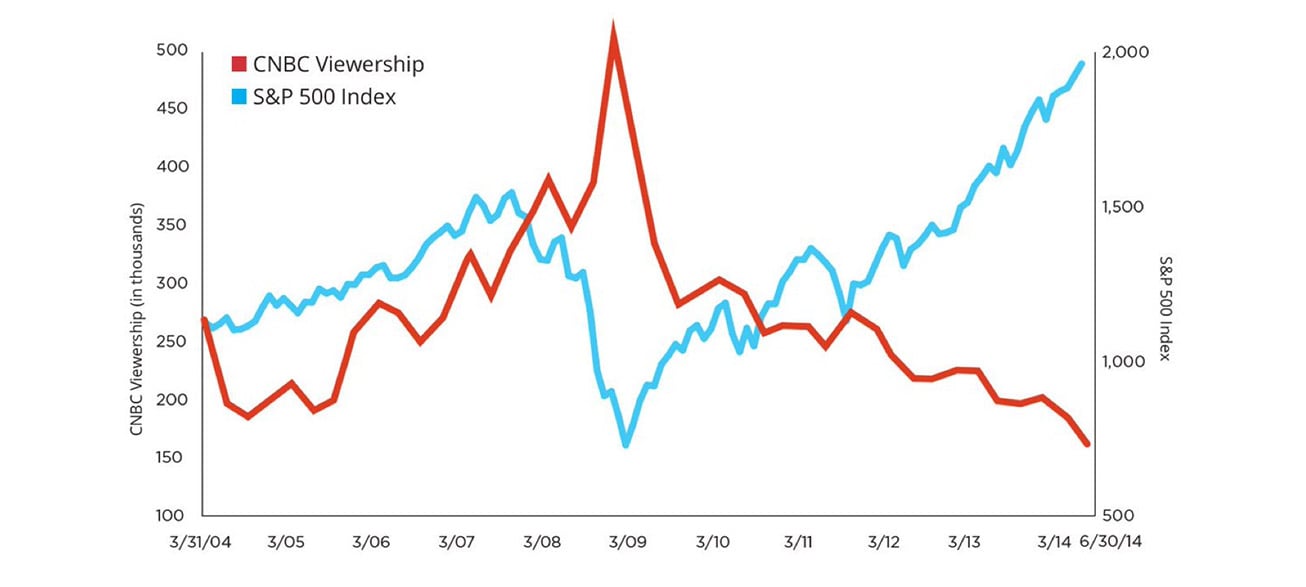

We think this difficulty exists because the marketability of ideas often takes precedent over investment merits. The financial media, moreover, knows that fear, arguably even more than greed, attracts viewers and readers. On Sept. 29, 2008, for example, CNBC’s ratings were the best ever as the markets experienced the worst one-day decline since the 1987 stock market crash. We think that fact is worth remembering, and worth sharing with clients, family and friends.

Source: Hartford Funds

Even now, advisors are telling us that they have many clients with sizable cash positions who have largely missed one of the greatest, if not the greatest, rally in the stock market’s history. They tell us that clients were scared, and scarred, by the financial crisis of 2008, and now, and only now, when the market is near historical highs, are clients finally getting interested in buying stocks. We all know this pattern. We all know how this story ends.

While Main Street struggles, many sophisticated investors have developed their own methods for dealing with news. They have come to view much of financial news as noise, which is to say information without economic value. These investors shun financial media. They think the information -or lack thereof – interferes with their ability to remain calm under pressure, and to make dispassionate financial decision. We know that approach may not be reasonable for those who do not employ a team of analysts, or professionally manage money, but we have a few ideas that may help.

Consider focusing on financial facts that are made truer by time.

We know, for example, that individual investors repeatedly “greed in” and “panic out” of the market. A possible antidote is learning to make a friend of fear. Investors can do this by recognizing that market events are usually never truly as bad, or as good, as they are described. Even when they are very bad – like the global financial crisis – buying when you feel like selling tends to work. Anyone who bought in March 2009 caught one of the world’s greatest market rallies.

To be sure, there’s a reason why the idea of buying fear, and selling confidence has become a cliché in the financial markets: it tends to work. When investors learn to view fear as a friend, rather than an enemy, they often take the first step toward freeing themselves from the boom and bust cycle.

We also find that it helps to have an investment framework. Our preferred approach is analyzing volatility because most portfolios go down when the CBOE Volatility Index, or VIX, rises. We also like focusing on the effectiveness of portfolio diversification because the old rules no longer work so well.

For the last three decades, as Barron’s Randy Forsyth recently noted, bonds rallied when stocks declined. This reflected investor expectations that lower interest rates would rescue the stock market. But now as interest rates are normalizing, inflation is near the Federal Reserve’s 2% target, and the labor market remains red hot, the so-called “Fed Put” may not be so effective. Thus, we focus on defining tail risk, and what might happen when investors have concentrated stock holdings.

Those four factors form the basis of our PRISM Rating ™ that we designed to make investing more predictable by simplifying the risk-management discipline that is common on Wall Street, but not on Main Street.

Bottom line: all disciplined investors are a little different in how they deal with market noise, and risk; but they have this in common: they use analytical frameworks to analyze the market and insulate their portfolios from big losses. If you don’t use ours, develop your own. You’ll find the investment world is a lot less noisy once you do.