Table Of Contents

As a financial advisor, you already know how unprecedented it is for a global health pandemic to impact the U.S. stock market powerfully. The incredible volatility that we are experiencing due to COVID-19 has been gut-wrenching for many, and your clients are likely to have several questions for you. Here is how to explain what’s happening with the stock market and the overall economy, easing their fears, without using complicated (and boring) technical explanations.

Start by Thinking Like Your Clients

A lot is going on with the markets that you understand, which your clients might not be aware of. Technical savvy sometimes does not translate to sales, and you need to make that conversation understandable. Whereas your clients look at data hyperbolized by media, showing the record-high unemployment levels, a steady rate of economic decline, and other negatives, you have a better grasp on the rational increases and declines of this market. Their fears and concerns are not surprising, and you should acknowledge them. Just look at some popular news headlines that send mixed messages to the public:

- The Stock Market is Ignoring the Economy – WSJ (Apr 17)

- Stocks close out April with their best monthly gains since 1987 – CNN (May 1)

- Record job losses, investors focused on reopening, Dow gains 450 – CNBC (May 8)

Based on headlines like these, your clients are likely wondering, “How can stocks have their best monthly gains as the economy becomes worse? Shouldn’t I sell my shares before another crash occurs?”

When a client reaches out to you with shock about what is happening in the stock market, it is your opportunity to clear up a few things. But first, take the time to listen to your clients’ fears and concerns.

Resolve Fears, Address Concerns, and Answer Questions

Fear of the unknown does not just affect the market. It also has a significant impact on how your clients’ react to certain situations. By listening, you can determine their substantial concerns and offer individualized solutions. If your clients are near retirement age, they might have concerns about changing their retirement plan or even wonder about pushing back their retirement to make up for lost income.

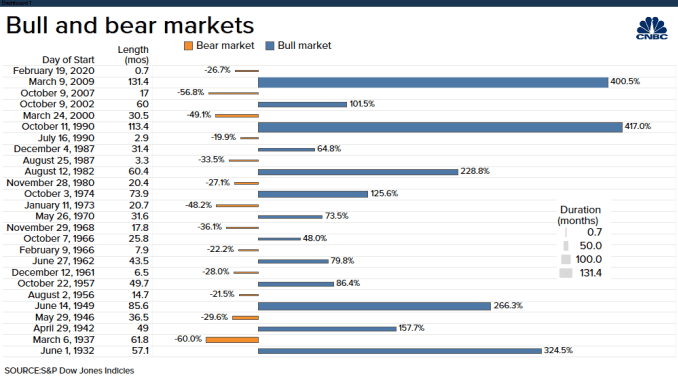

Source: A Look at Bull and Bear Markets Through History – CNBC

Over the years, especially after the 2008 financial crisis, portfolios rebounded and exceeded previous values over time. Remind your client of this fact and help them determine whether it’s right to stay the course until the market volatility is over, or offer to review and possibly make changes to their retirement strategies, to match their needs.

What if your clients are not nearing retirement and are fearful, concerned with losing money, or simply questioning why the stock market seems to act irrationally? In these cases, it may be time to meet (digitally) with them, review their financial situation, and stick to the facts.

While you already know that the stock market prices reflect future expectations, your clients might not be aware of this.

There are other points to explain to your clients, which can help them understand why the stock market is acting more predictably than an average investor might expect.

How to Explain COVID-19 Volatility to Your Clients

1. In economic downturns, there will always be winners and losers.

Your clients are likely already aware of this. However, you can spin it to explain why specific market indices and stocks seem to be doing better than expected, given the circumstances – diversification matters. A great line to use is that if you do not hate part of your portfolio, you’re not diversified. And that’s because proper diversification requires assets that do well at different times, and the current recession is no different.

For example, major players in the tech sector have done well, while the energy sector suffers. However, the big five tech stocks make up a more significant percentage of the market than the entire energy sector. Thus, as larger sectors outperform while smaller sectors plunge, we often experience overall market increases. This can give clients more perspective.

2. Congress and the Federal Reserve have both shown willingness to stop businesses from experiencing an economic depression.

Source: COVID Response From

Your clients, many of whom may have received a stimulus check from the CARES act, understand the direct importance of receiving $1,200 per adult and $500 per child in their household. However, what they might not realize is how government stimulus and the central bank’s actions are helping to rebound the market. Take time to discuss that government stimulus, which puts money in the hands of unemployed people, is one of several things that is helping to stabilize the market. Nearly $3 trillion of relief packages stopped us from reaching lower lows.

Also, there are economic studies done that show there is a multiplier effect of government stimulus. Every dollar a government spends turns into more than a dollar for the economy.

On top of government intervention, the Fed’s monetary policy gives investors’ confidence and helps prevent bankruptcies by providing liquidity. We currently have historically low interest rates. The Fed is purchasing assets through the quantitative easing program, removing restrictions that make it easier for banks to loan money, and adding liquidity to the markets by issuing credit to businesses. These sprawling actions all help recoup earlier stock market losses.

3. There will eventually be a recovery, and forward-looking investors are focusing on that instead of looking at revenue losses over the next 12 months.

Most market confusion comes from a misunderstanding of the connection between economic reports and stock market performance. Be sure to reassure your clients that the market has, and will, continue to react to positive press about the future economy during volatile periods. Alternatively, most of the negative news about the past several months is already priced into the market. This explains why we can also see stock price increases on a day when we receive terrible unemployment data.

In Conclusion, Markets Will Have Bad Days, but History Shows That We Will Recover

Even though things look gloomy and we will continue to receive bad economic news, we know that there should be a recovery in 12 to 18 months. The world is not ending. For every investor looking to sell in fear of losing money, there is another investor that believes this is a good time to invest and secure profits for the eventual recovery. After all, the best strategy in any market, especially during challenging times, is a long-term investing approach. Our mission as advisors is to educate clients and ensure that they make the best investment choices possible during this unprecedented time. Or, at a minimum, stop them from making a drastic mistake by not following their financial plan.